In undoubtedly too brutal a manner, the director-general of the IMF Christine Lagarde dotted some 'i's last weekend in an interview to British daily The Guardian. She expressed her astonishment at the Greek feeling of injustice. For her, Greece is not in particularly dire straits.

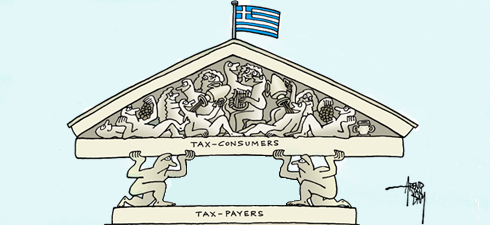

"I think more of the little kids from a school in a little village in Niger who get teaching two hours a day, sharing one chair for three of them, and who are very keen to get an education. I have them in my mind all the time. Because I think they need even more help than the people in Athens." For Lagarde "the Greeks should also help themselves collectively." This can be done "By all paying their tax," she suggested.

Beyond the harshness of the comments, which are rather inappropriate just three weeks before the next elections, Lagarde hit a nerve. It is true that investors were wrong to make risky loans to Greece for twenty years. But they have paid a high cost for this by forgiving 70% of their debts (a good part of which concerns Greek investors themselves, banks, insurance companies, pension funds) or 105 billion euros. This is the greatest debt restructuring scheme in the history of capitalism (only US$88 billion to bail out Argentina).

The fall of Greece could result in the collapse of the single currency. Therefore, out of calculated solidarity, the eurozone and the IMF have lent Athens a total of 240 billion euros (in the long-term, the total amount has yet to be released). To that must be added (at least) the 50 billion in Greek government bonds bought on the secondary market by the European Central Bank. That totals 290 billion euros, about 2.5 times the annual EU budget for a country of 11 million residents representing no more than 2% of the EU's gross domestic product (GDP). The IMF, which, alone, has provided one third of this amount, has never, in its entire history, lent so much to a single country.

State less efficient than Turkey

We would do well to remember that this solidarity did not start with the crisis. Since joining the EU in 1981, and especially since the creation of structural funds (regional development aid) in 1988, Greece has received 3-4% of its GDP in European aid.

Not to mention that since 2002, when it joined the eurozone, Greece has been able to borrow on the market at German interest rates. What was done of this unprecedented influx of funds? What is sure is that it did not serve to develop the country but served instead to maintain political patronage and to boost consumption – Greece is a major European market for high-end German cars.

The growing annoyance of the Europeans and of the IMF with what they see as the ungratefulness of a country that has barely escaped a bankruptcy that would have led to much more tragic effects than has the current cure of severe austerity.

The adjustment programme outlines all the reforms that Greece must achieve in order to build a State. Reading between the lines is enlightening. All the administrative sectors, the health system, tax administration, legal system and public bids were reviewed and show that Greece has a State that is less efficient than Turkey's.

A patronage political system

The problem is that Greece does not do its duty, both because of the incompetence of a large part of its politicians and of the administration but also because of resistance by those who have everything to lose if the reforms see the light of day. The first austerity programme, negotiated with the IMF and the EU in the spring of 2010, was never applied, as the now defunct Papandreou government has admitted, and the second is on the rocks since the previous elections on May 6th.

Adopted a year ago, the law which opens up 150 professions to competition has yet to be applied due to lack of administrative will. Creating a business is still as difficult as ever. The land registry rolls are still not completed (although the Union has been requesting this for 20 years and even paid to help the Greeks to establish the rolls). And when the tax office does do its job, the justice system – inefficient and corrupt – does not do its share thus allowing tax evaders to escape paying taxes.

To give an idea of the sums in play, tax fraud was estimated at between 15 and 20 billion euros in 2009, representing three quarters of the budget deficit at the time. Not surprisingly, the underground economy (30-40% of GDP) remains flourishing.

There are people suffering in Greece; that is indubitable. Lower salaries, smaller pensions and the recession (Greece has lost 30% of its national wealth, which remains painful even if it was acquired on credit), are all sad realities. But it is a national choice. There is a preference for a patronage political system (the parties that want to end it obtained less than 3% of the vote) and for voting for the parties that promise obtaining international aid without having to make an effort. Other countries are submitted to austerity measures just as strict (Portugal, Ireland, Spain and Italy) yet, they are not so vocal.

A bottomless pit

So what is the difference? Other than Greece's penchant for victimisation, it thinks it should have special treatment because it is the cradle of Western civilisation. As if Rome were to invoke Cicero or Augustus when Italy is asked to reform its labour market or to fight against the Mafia.

So what can be done? Europe has no other choice than to continue to help Greece which can, by itself, destroy the single currency. But the Greeks must also be reminded that the adjustment programme was accepted by the legitimate government of Greece and ratified by the 17 national parliaments of the eurozone (including the Vouli, the Greek parliament) which should be enough to squelch talk of a 'German diktat'.

Mostly, a unilateral questioning of the programme would show that Greece can still not be trusted; a new majority would not feel bound by the commitments made in the name of the country. Suffice it to say that a victory of the radical left would bury, for a long time, the federal leap needed for the survival of the euro.

It is clear that Europeans will never see the money they have lent to Greece. But this inevitable forgiving of debts must not be carried out any which way. Greece, whether it likes it or not, must change and carry out far-reaching reforms. Giving up our debts unconditionally, as some suggest, ignores that this is an effort that weighs on all Europeans and would guarantee that we will have to put more into the Greek pot within twenty years. Attempting to fill a bottomless pit, that is one bit of ancient Greek heritage that we could all live without.

Was this article useful? If so we are delighted!

It is freely available because we believe that the right to free and independent information is essential for democracy. But this right is not guaranteed forever, and independence comes at a cost. We need your support in order to continue publishing independent, multilingual news for all Europeans.

Discover our subscription offers and their exclusive benefits and become a member of our community now!