Two centuries or so ago, French aristocrats chose exile to escape the "sans culottes" [revolutionary rabble] and the guillotine. New times, new trends. Today the (very) wealthy today choose fiscal exile to flee taxation that they see as killing them or, at the very least, as "expropriation".

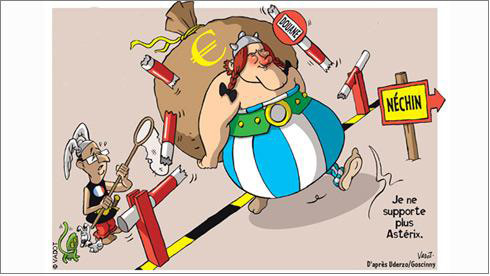

Gérard Depardieu is one of these people. And, as is often the case with this icon of the French cinema, his case has taken on proportions that are as huge as they are incongruous. His choice, announced in early December, to reside in Belgium is unambiguous: he intends to benefit from the benevolent tax policies on the other side of the border.

He was not afraid to set off a national drama worthy of his celebrity status. "Pretty pathetic," commented Prime Minister Jean-Marc Ayrault. "Who are you to judge me in this way?" Depardieu replied with his best dramatic flourish, even threatening to return his passport and to give-up his French nationality.

Slanging match

This set off a new hue and cry with the Labour Minister referring outright to "a kind of personal decline" and the Minister of Culture, showing a tad more humour, called on the actor to "return to silent films".

One Socialist MP went so far as to suggest that tax exiles be stripped of their nationality. Playful minds will see in this "affair" a surrealist farce. The more politically-minded will see a cold response of the wealthiest to the severity of French tax authorities as well as the demonstration that, for them, managing their capital is of much greater concern than the national interest. Nonetheless, everyone would do well to think about the cause of this drama.

It goes back to the presidential campaign. Wanting to make an impression and to provide some guarantees to the Left, François Hollande caused a surprise by proposing to tax revenues above €1m at a rate of 75 per cent.

Seen as expropriation by conservatives - which is questionable since similar rates existed previously in the 1970s [under conservative governments] - the rate was justified, he assured, by the duty of solidarity and the need to redress calamitous public accounts. Obviously, these arguments did not convince those concerned. There is a reason for this.

Punitive rate

On the one hand, the 75 per cent rate seems punitive. If Hollande wanted to respect the spirit of the Declaration of Human Rights, according to which citizens must make tax contributions "according to their ability", he would have imposed two, three, even four additional brackets, reaching, if need be, the rate of 75 per cent.

On the other hand, it shows that fiscal policy in a single country is inefficient in these days of globalisation and of free circulation of European citizens.

Holland runs the risk of paying the political price for his shock electoral announcement last spring. He may be dragging this controversy in the same way [former conservative President] Nicolas Sarkozy towed his fiscal shield [which, conversely, capped taxes on the wealthiest].

Raising taxes is necessary; the wealthiest must contribute more than the others. But, in the end, the symbolic brutality of the 75 per cent rate undermines this message.

The view from Brussels

Discreet irony in Belgium

While Gérard Depardieu’s decision to become a tax exile in Belgium has met with invective in France, it is viewed with irony and amusement by the Belgian press. A case in point is La Libre Belgique whose December 17 edition headlines with “Cross-country actor seeks clement fiscal climate,” and features a report on the French actor’s request for information on the conditions he would need to fulfil to obtain Belgian nationality.

Adopting a more critical standpoint, the Le Temps correspondent in Brussels remarks on “Belgium’s silence” amid the controversy. While French President François Hollande has “confirmed his intention to renegotiate tax agreements” with the government in Brussels, Belgian Prime Minister Elio Di Rupo has carefully avoided mention of the subject. And with good reason, notes Richard Werly

on the Belgian side, there has been no official comment on “the affair” and the controversy which was reignited by Gérard Depardieu’s angry letter of last Sunday. It is a silence that reflects two very obvious facts: the continuing political vulnerability of Elio Di Rupo, and the treacherous nature of the general question of capital flight and the particular issue of taxation in Belgium.

The silence of Elio Di Rupo, who was careful not to comment on the arrival of another tax exile, French billionaire Bernard Arnault, is indicative of the limits imposed by the complex political situation in Belgium, and by the European action plan to strengthen the fight against tax evasion, which was presented by the European Commission on December 6 in Brussels.”

Was this article useful? If so we are delighted!

It is freely available because we believe that the right to free and independent information is essential for democracy. But this right is not guaranteed forever, and independence comes at a cost. We need your support in order to continue publishing independent, multilingual news for all Europeans.

Discover our subscription offers and their exclusive benefits and become a member of our community now!