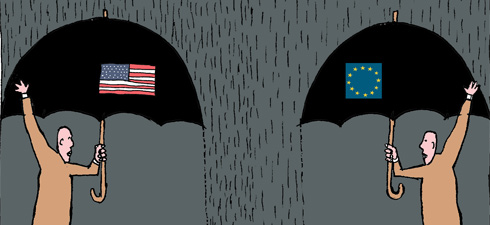

The G20 summit on 11/12 November in Seoul comes at a time of turbulence in international economic coordination. Given the US economic slowdown and its decision to adopt an aggressive monetary policy, it looks as though Washington wants to unload the cost of re-stabilising the global economy on others. What is most troubling, however, is the rapid deterioration of economic relations between the United States and the European Union.

Right after Seoul, the US and EU will be meeting again in Lisbon fora summit that would have made a lot more sense before – and not after – the G20, a summit far too crucial to be treated as an afterthought. The recent souring of US-EU relations starkly contrasts with the 12-month aftermath of the Lehman crisis – which was a sort of “golden age” of global governance, in which both the US and Europe recognised the urgent need to reinforce economic policy coordination.

That recognition was to pave the way for the development of global institutions for economic governance. As a result, when the G20 was held in London in April 2009, at the very peak of the economic crisis, the whole cooperative framework, including consensus on the need for fiscal stimulus, seemed to be firmly in place.

Global governance has been revolutionised by the crisis

But the rapport between the US and EU began falling apart towards the end of 2009 and continued to crumble in 2010, to the point where they eventually took diametrically opposed positions at the G20 summit in Toronto: the Europeans sought exit strategies for the stimulus policies, convinced that further deficits and cash injections would destabilise their economies. The Americans, on the other hand, saw US growth in jeopardy and pushed for supplementary stimulus measures. In 2009–2010 it emerged that the great rebound of the US economy was unsustainable and, as US and EU economic conditions began drifting apart, so did their "chance cooperation” and things reverted to the political divergences of the previous ten years.

A more temperate take on the matter would be that the US and EU have yet to calibrate their cooperation on the new global picture that has emerged from the crisis, which is marked by three factors: the diminished importance of the transatlantic economy, the relationship between long-term growth and fiscal policies, and the need for national and regional policies that take global imbalances into account.

Global governance has been revolutionised by the crisis. The G20 has superseded the G7 as the foremost forum for consultation between governments and central banks. The G10 is no longer the hub of monetary coordination, which is now centred in the Global Economy Meeting (GEM) in Basel, with 34 central bankers in attendance. TheFinancial Stability Board has increased the number of its member countries well beyond the G7. And last but not least, theInternational Monetary Fund is revising its capital quota system – and reducing European leverage in the process.

US and EU are going to agree to reject protectionism

Hence the need for the US and EU to recalibrate their relations based on this new framework. It is impossible to discuss euro-dollar exchange rates in our day, for example, without factoring in the renminbi. And were they to do so, the US and EU would rediscover the utility of cooperating. Ultimately, the US and EU will have to ask themselves “who is going to sustain consumption”, and then once again coordinate their approach to the emerging economies.

But coordinating political economies won’t work unless national policies allow for the need to put the world economy back on an even keel – which is precisely what is not happening these days. At the summit in Lisbon, the US and EU are going to agree to reject protectionism, lower barriers to (especially environmental) technology transfers, and jointly commit to innovate on efforts to protect jobs. But they’ll also have to put the issue of global re-equilibrium on the negotiating table, which won’t be a credible undertaking without coherent internal policies. And thus far the signals have not been that way tending.

Even if the US-EU summit in Lisbon is not the place for monetary negotiations, Washington should publicly commit to policy coordination and the EU should show up with a credible framework for economic governance. Without commitments that factor in the impact of local policies on third countries, the transatlantic agenda is liable to lose what’s left of its credibility for good.

Translated from the Italian by Eric Rosencrantz

G20

Europe on the sidelines

The G20 in Seoul "is just one example of the shift in the global centre of gravity from the Euro-Atlantic arena to the Trans-Pacific region,"remarks Frankfurter Allgemeine Zeitung, which believes that Europe will have trouble defending its interests at the summit of the world’s most industrialised countries in the South Korean capital. The German daily points out that Europe was at the forefront of the campaign to have developing countries included at meetings of the organisation, which aims to "facilitate" cooperation on international economic policy. However, it "has now been forced to set aside hopes that those countries would be accommodating and willing to share in global responsibilities." It is for this reason that Europeans "will have to struggle to create coalitions to defend their interests and to establish a consensus" — a task made more difficult by the fact that the "EU is invariably divided andnot adequately represented."

Another consequence of this state of affairs,notes Slate.fr, is the sidelining of Europe in the "currency war," which the G20 is supposed to prevent. The news website explains that the inflexibility of European treaties and the position adopted by the European Central Bank, which is often criticised as too dogmatic, have prevented Europe from playing a more active role. However, “the real problem on this side of the Atlantic is a lack of reflection on the economy. All we really ask of governments and central banks is to do nothing when everything is going well and to aggressively intervene when things go awry. Viewed in these terms, Europe is necessarily ineffective: an awkward structure that is more difficult to manoeuvre than a nation state, it is always either too present or glaringly absent.”

Was this article useful? If so we are delighted!

It is freely available because we believe that the right to free and independent information is essential for democracy. But this right is not guaranteed forever, and independence comes at a cost. We need your support in order to continue publishing independent, multilingual news for all Europeans.

Discover our subscription offers and their exclusive benefits and become a member of our community now!