The S&P downgrade merely reflects European leaders' failure to regain solvency, says Constantin Gurdgiev.

"In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could," as Rudiger Dornbusch remarked some years ago.

Friday the 13th – the day Standard and Poor's (S&P) downgraded nine euro area sovereign bond ratings, stripping Austria and France off their AAA status, cutting Italy, Spain, Portugal and Cyprus’ rating by two notches, Malta, Slovakia and Slovenia by one notch each and placing 14 eurozone countries on negative watch for future downgrades. Finland, the Netherlands and Luxembourg are now also facing the potential loss of their AAA ratings. Greece is now in the imminent default territory and Italy is rated in the same risk group as Kazakhstan – BBB+.

Perhaps more importantly, the announcement came as no surprise. Ratings agencies like S&P are lagging market indicators, simply belatedly confirming what we all already know. The immediate significance of the Friday move, therefore, is its impact on the mandate-bound investors – pension funds, insurance funds and a small number of investment funds – which respond directly to changes in risk ratings and rankings. This will see some substantial dumping of the bonds by those investors, directly prevented from holding riskier assets. The medium-term impact will be in reduced liquidity in markets for the sovereign bonds most impacted by the ratings downgrades and possible hikes in margins on these bonds. This will further undermine their liquidity and mount new losses on the balance sheets of those institutions holding them. In the longer-term, the impact of Friday’s announcement will be much more dramatic, as the political embarrassment that follows the downgrades is likely to force political responses – something that Europe has already shown it is not very good at.

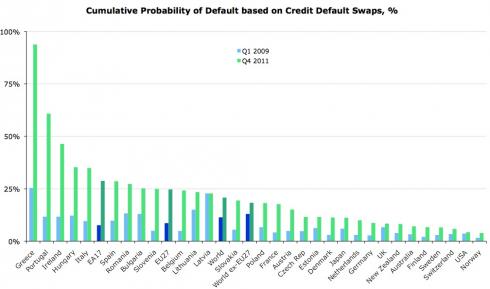

Nevertheless, the announcement still managed to catch European leaders off-guard. But forget ratings and look at the actual market-expected probabilities of sovereign default. In Q4 2011, thirteen out of twenty highest risk countries, as measured by the implied probability of sovereign default, were members of the EU27, of which seven were members of the euro area. France’s Credit Default Swaps were trading at mid-point levels consistent with those of Morocco and Tunisia. Thirteen EU27 countries had Credit Default Swaps rates consistent with the implied probability of sovereign default in excess of 20 percent. A week ago, AAA-rated Austria sported a credit default swap rate similar to BBB-rated Philippines and Thailand. The only euro area country that managed to make it into the top 5 performers worldwide in terms of implied probability of default on its sovereign debt was Finland, with the closest euro area comparative being Germany in world’s number 10 position. Finland, (number 5), Germany (number 10) and the Netherlands (number 15) are the only three euro economies in the top 20 performing states in the CDS league table published by CMA.

All of this amounts to a very public international embarrassment for the euro area’s leaders, for the ECB and the entire EU. An embarrassment that is wholly of the EU’s own making. These latest ratings and the market perceptions of euro area risks that underlie them are the outcomes of the combination of policy failures that stand at the heart of the European ‘project’. They are caused by sustained deterioration of the macroeconomic fundamentals. Anemic growth, stagnant conservatism, inability to change, incapacity to reward entrepreneurship and governance structures that are non-transparent and politicised – all describe Europe of today. All of these are the underwriters of the European failure to recognise and resolve the ongoing crisis.

In recent years (not months), Europe collectively has undertaken policies designed to supply morphine to the dying economies of Greece, Italy, Portugal, Spain and Belgium, while at the same time collectively destroying the only viable economy in Europe’s ‘periphery’ – Ireland. Even today, in the wake of a tsunami of evidence to the contrary, European leaders continue to insist on pretending the EU’s problem is a crisis of liquidity. But it’s not. It’s a crisis of solvency.

Perhaps the most telling response to the S&P announcements has come so far not from the markets – which had already factored in likely downgrades – but Europe’s leaders. Mr Sarkozy’s emotional outburst in the wake of the French downgrade and the knee-jerk reaction of Europe’s most serial crisis denier, commissioner Olli Rehn, were not the signs of leadership confidence and ability, but the acts akin to a junior school child smashing his calculator for giving him an answer different to the one he wanted.

Amidst this, can anyone be really surprised that the more acute issues of the week – collapse of Greek talks on private sector involvement in bond restructuring, the abysmal showing of the peripheral economies – save Ireland – in the latest trade balance figures and the disastrous news on unemployment from Spain – have been sidelined with a show of fake indignation at the S&P downgrade? Not really. As Rome burns, Rome goes on complaining about the lack of wine and circuses.

Image by Fernando D. Ramirez. CC licenced.

Was this article useful? If so we are delighted!

It is freely available because we believe that the right to free and independent information is essential for democracy. But this right is not guaranteed forever, and independence comes at a cost. We need your support in order to continue publishing independent, multilingual news for all Europeans.

Discover our subscription offers and their exclusive benefits and become a member of our community now!