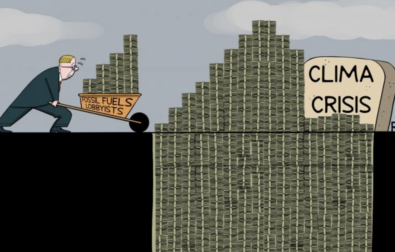

Amundi Investment Solutions, a French asset management company, is Europe’s leading asset manager and ranks among the global top ten, with a portfolio exceeding two trillion dollars. Between 2024 and early 2025, Amundi allocated 1.1 billion dollars to investments in the fossil fuel sector through so-called green funds that comply with Environmental, Social, Governance (ESG) criteria, and which are therefore expected to promote sustainable and ethical activity. Extending our analysis back to 2023, the total amount of funds defined as green and allocated to the fossil fuel sector amounts to 1.7 billion dollars, according to analysis of data from the London Stock Exchange Group (LSEG) platform.

In order to reach the carbon neutrality envisaged by the 2015 Paris Agreement, the European Union is committed to “making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development”, in line with ESG criteria. The latter are used to evaluate companies’ environmental, social and governance practices to determine their accountability and sustainability.

With this in mind, the European Sustainable Finance Disclosure Regulation (SFDR), in force since 2021, divides financial funds into three categories: Article 6 funds, which do not take environmental parameters into account; Article 8 funds, also known as “light green” funds, which do not have specific ESG objectives but promote ESG characteristics; and Article 9 funds, or “dark green” funds, which promote clearly defined sustainability objectives.

However, Article 8 funds can still include investments in companies linked to fossil fuels. In recent years, with stricter rules introduced by the European Union for Article 9 funds, many asset managers, instead of reviewing their investments, have chosen to switch dark green funds to light green in order to avoid incurring penalties. According to Amundi's website, 11 funds have undergone name changes, based on the European guidelines of May 2024. In six of these cases, Amundi has removed the designation Net Zero or ESG.

After the EU guidelines were issued, Amundi changed the names of finds by removing terms associated with sustainability. The investments themselves were not modified, and continued to finance leading companies in the fossil fuel sector.

Amundi, however, continues to promote its investments as “responsible.” Accessing its Italian webpage as a potential investor, the section dedicated to “investing responsibly” appears at the top of the page, alongside investment goals and themes.

The French company claims that it is interested in “making a positive contribution to a better future”, because “climate change is one of the greatest challenges of our time.” As a way to take “urgent action”, the site proposes that investors make a difference by investing in the ESG solutions offered by Amundi.

The companies

We tracked the 38 Amundi funds that were still designated as “sustainable” in March 2025, but which, in reality, invest in fossil fuels. The company that receives the most investment from Amundi’s green funds is TotalEnergies, a French multinational that is among the world’s top four petroleum companies. TotalEnergies has received a total of 438 million dollars from Amundi’s green funds. This is more than triple what Amundi has invested in Shell, which has received around 145 million dollars. Next is Mitsubishi UFJ Financial Group, with 108 million, Repsol with 98 million, and Exxon Mobil with 92 million. The rest is divided between companies such as EQT AB and Equinor ASA that receive around 40 million dollars, and others such as Inpex Corp and BP PLC which receive between 3 and 8 million.

It should be noted that according to Carbon Tracker’s Paris Maligned III report none of these companies have decarbonisation targets aligned with the Paris Agreement.

TotalEnergies

TotalEnergies is the energy company in which Amundi has invested the most. Sustainalytics, an organisation that evaluates corporate sustainability gives TotalEnergies a “high” ESG Risk Rating, indicating that in the coming years TotalEnergies is likely to encounter significant problems concerning its environmental, social and governance performance.

In its latest sustainability report, TotalEnergies intends to achieve net zero emissions by 2050 by sourcing 25% of its energy production from low-carbon molecules (biogas, hydrogen and synthetic fuels), 50% from renewable sources and the remaining 25% from fossil fuels and liquefied natural gas (LNG). In 2024, the percentage of its energy production from fossil fuels and LNG was 87%.

To achieve 50% of electricity production from renewable sources, the French company will rely on investments in Brazil, a country that is described in the company's sustainability report as a “key country for the company's Multi-Energy Strategy”. Brazil is indeed a key player in energy supply. According to a 2024 study by Rystad Energy, it will produce 7 million barrels of crude oil per day by 2030. This represents a 56% increase compared to 2023, and almost three times more than in 2010.

According to the Rystad Energy report, TotalEnergies is the leading energy company in Brazil, with a decade-long partnership with Petrobras and Casa dos Ventos. Petrobras is Brazil’s state-owned fossil fuel extraction and production company, while Casa dos Ventos is one of the leading renewable energy project developers in Brazil, specialising primarily in wind and solar power generation. With Petrobras, TotalEnergies is investing in the Mero Field, an oil extraction project in several pre-salt deposits (situated in the ocean depths beneath a thick layer of salt) off the Santos Basin, approximately 180 kilometres from Rio de Janeiro. In collaboration with TotalEnergies, Shell and other oil companies, Petrobras is responsible for the construction of four offshore extraction platforms in the pre-salt deposits, renowned for the quality and quantity of raw material extracted.

The project, divided into four phases – Mero 1, Mero 2, Mero 3, Mero 4 – is TotalEnergies' primary focus. Mero 3 Field, an offshore platform off the Santos Basin, has a production capacity of 180,000 barrels of oil per day, compared to 40,000 for Mero 1, which was inaugurated in 2021. The Mero 4 Field began production on 26 May this year, with a production level equal to that of Mero 3.

TotalEnergies has also signed an agreement with Petrobras to deploy AUSEA technology (Airborne Ultralight Spectrometer for Environmental Applications) to monitor greenhouse gas emissions – methane and carbon dioxide in particular. Concerns have been raised about the environmental sustainability of this project. Over the years there have been incidents at some Petrobras facilities, though none have involved the Mero Field project.

The most recent incident occurred on 21 April this year, when a fire broke out on the Cherne 1 platform in the Campos Basin, sending a column of thick black smoke into the air. Since 1972, there have been eight serious accidents at Petrobras facilities, some of which have resulted in the deaths of several workers and extensive environmental damage. In the year 2000, in Guanabara Bay in the state of Rio de Janeiro, a broken oil pipeline caused a spill of 1.3 million litres of oil, resulting in one of Brazil’s most devastating environmental disasters.

Shell

The second largest recipient of green investments managed by Amundi is the British company Shell, with a budget of 145 million dollars. The fossil fuel company is hardly an obvious choice for funds classified as green by investors.

The British company is currently embroiled in a trial in London, where two Ogoni communities in the Niger Delta accuse the company of polluting the area with oil spills between 1989 and 2020. The verdict, expected in October this year, could establish the company's liability in one of the most polluted areas in the world. According to the prosecution, the clean-up efforts carried out so far have been inadequate.

Shell has also faced fresh criticism for the environmental impact of more recent activities. In Nigeria, where the company continues to operate on remediation projects, oil spills increased by 122% between 2023 and 2024.

At the same time, the company's reports indicate that ecotoxicological tests were conducted on 20,000 fish specimens in 2022. These tests, which form part of environmental and health monitoring practices, are used to assess potential chemical risks to humans and the ecosystem. One of these studies, funded by Shell, written by authors linked to the company and reviewed by its lawyers, concluded that consuming seafood caught in the area would not pose significant carcinogenic risks.

Meanwhile, in 2023, the number of vertebrates used in testing more than doubled, reaching 58,738.

The company’s 2024 sustainability report openly acknowledges that, based on current operational planning, it is not on track to meet its 2050 climate targets. The company strategy is defined as mirroring the performance of society as a whole: if the world succeeds in achieving net zero emissions, then Shell will also be able to align itself with that achievement. However, if the global context proves to be less sustainable than expected, there is a “substantial risk” that the company will fail to meet its commitments.

The question of transparency

Changes in the composition and criteria of “sustainable” funds are rarely communicated to investors with any transparency. Over time, some investors in Amundi funds may remain unaware that companies like TotalEnergies and Shell are among the largest recipients of capital raised by one of Europe's leading ESG fund managers.

The decision to align with the new guidelines of the European Securities and Markets Authority (ESMA) by changing the names of funds, rather than reviewing allocations, allows compliance with current regulations without changing the current strategies. This choice does not conflict with ESMA guidelines, but defers the issue and delays the achievement of net zero by 2050.

It is not immediately clear from Amundi's website how sustainable funds are actually allocated, even though they are one of the company's stated priorities. The website has a clear focus on the theme of sustainability. When we asked for comment on how they support companies in the transition, Amundi did not address the 38 funds we tracked that finance fossil fuel companies. However, it did point out that “the collective goal of carbon neutrality cannot be achieved simply by excluding companies in the energy sector. Amundi therefore accompanies and encourages their transformation, ensuring that they implement a climate strategy in line with the objectives of the Paris Agreement. [...] Specifically, this translates into rigorous and continual dialogue with companies to encourage them to set ambitious reduction targets for greenhouse gas emissions, and raise their awareness of best practices in environmental transition.”

None of the companies in which Amundi has invested are currently in line with the Paris Agreements. It is therefore difficult to understand how the French financial institution is encouraging and pushing them towards ecological transition.

👉 This article on IrpiMedia

🤝 This article is published in collaboration with IrpiMedia; it is part of Voxeurop's investigation into green finance and was produced with the support of the European Media Information Fund (EMIF). The sole responsibility for any content supported by the European Media and Information Fund lies with the author(s) and it may not necessarily reflect the positions of the EMIF and the Fund Partners, the Calouste Gulbenkian Foundation and the European University Institute.

Do you like our work?

Help multilingual European journalism to thrive, without ads or paywalls. Your one-off or regular support will keep our newsroom independent. Thank you!