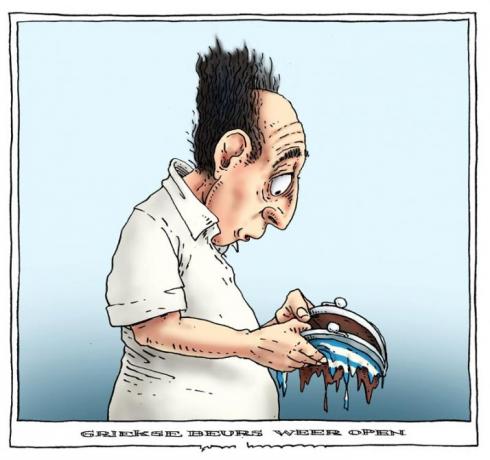

Greeks stocks hit a record loss this week, as Athens' stock exchange opened on 3 August five weeks after the government imposed capital controls to prevent a bank run and stave off financial collapse at the height of its standoff with EU-IMF creditors over a new bailout. On Monday, the main Athens index lost 16.2 per cent, while the Greek banking index was down 21 percent and three of the main four lenders were near the maximum allowed drop of 30 percent.

Debt-crippled Greece and its creditors have to reach a deal on a new rescue package in time for August 20, when it is due to pay the European Central Bank 3.4 billion euros.

We hope you enjoyed this article.

Would you consider supporting our work? Voxeurop depends on subscriptions and donations from its readers.

Discover our offers from €6/month including subscribers-only benefits.

Subscribe

Or make a donation to bolster our independence.

Donate