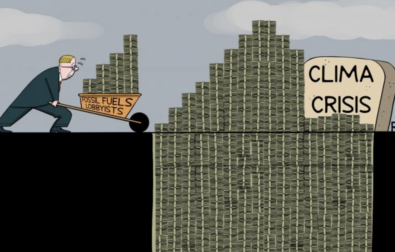

One of the objectives of the Paris Agreement is “making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development”. However, many international asset managers continue to finance some of the world’s most carbon-intensive fossil fuel companies, including ExxonMobil, Shell, and TotalEnergies, through investments marketed as “green”. These are also companies that still do not comply with the objectives of the Paris Agreement.

Since the financialisation of the economy in the 1980s, the world of finance has taught us that every loophole in the law conceals an opportunity for short-term gain. Such gaps in the rules governing green finance, along with the inattention of regulators and the good faith of environmentally conscious investors, have created just such an opportunity.

Led by two experts in the field – multi-award winning investigative journalists Stefano Valentino and Giorgio Michalopoulos – this project sets out to expose the abuses and deceptive practices behind many investment products presented as “sustainable”. While public interest in responsible finance only grows, so many products labelled as “ESG”, “green bonds” or “sustainable investments” actually rely on misleading labels and lax criteria.

This series is produced in partnership with IrpiMedia and is supported by the European Media Information Fund (EMIF).

📺 Check out the Live event with Stefano and Giorgio on the broken promises of green finance.