Fact check: In December 2020, a group of big players in international finance launched the Net Zero Asset Managers initiative. They committed their firms to “supporting the goal of net-zero greenhouse gas emissions by 2050 or earlier, in line with global efforts to limit warming to 1.5°C”. They planned to do this by directing investments toward sustainable businesses that are helping to cut the emissions responsible for the climate crisis.

Context: Article 2c of the Paris Climate Agreement called for financial flows to be consistent with “a pathway towards greenhouse gas-emission-resilient development". Over 230 global banks and asset-management firms subsequently signed up to the Net Zero Asset Managers initiative, launched in 2020 with the aim of “supporting the goal of net-zero greenhouse gas emissions by 2050 or earlier”. Alas, those firms’ investments tell a different story.

Launched in 2020, the Net Zero Asset Managers initiative committed its members to “supporting the goal of net-zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.5°C”. Over 230 firms signed up to it, including European ones such as Germany's DWS, the Netherlands' Robeco, France's AXA, and Italy's Eurizon. Some of these we have covered in previous reporting due to their ostensibly “green” investments in the fossil-fuel industry.

NZAM carried the institutional imprimatur of the United Nations, in the form of the UN Principles for Responsible Investment. UN PRI signatories commit, among other objectives, to incorporating “ESG [environmental, social and governance] issues into investment analysis and decision-making processes”. Specific ESG criteria are used to assess the sustainability and ethical impact of an investment.

Net Zero Asset Managers has received significant media coverage, giving the impression that it is a force for change. In November 2022, for instance, the specialist magazine ESG Today headlined, “Net Zero Asset Managers reaches $66 trillion in assets under management”. The article explained that the signatories were committed to “progressively transforming their investment portfolios to align them with the goal of net-zero greenhouse gas emissions by 2050". NZAM was covered on the UN's website in an April 2021 article titled “Biggest financial players back net zero”.

NZAM's media profile has allowed its signatories to flaunt their commitment to the Paris climate accord and to market themselves as being mindful of sustainability.

That commitment was short-lived. In January 2025, signatories including BlackRock and JP Morgan withdrew from NZAM, prompting the suspension of its activities. The NZAM secretariat indicated on its website that the project was undergoing a review, “to ensure it remains fit for purpose in the new global context”.

During the lifetime of Net Zero Asset Managers, how far did the signatories live up to their own much-fanfared commitment to “Net Zero”?

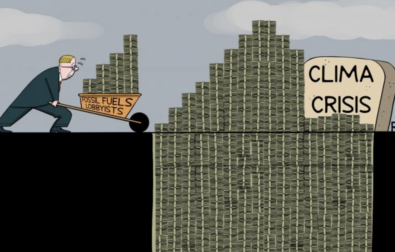

Our research shows that, at the high point of NZAM's activity in the last quarter of 2023, its members held the equivalent of $25 billion in fossil-fuel stocks in their “green” investment portfolios. Moreover, that sum included companies responsible for so-called “carbon bombs”, a term coined in 2022 by Kjell Kuhne, a campaigner at Leave it in the Ground (Lingo), to refer to hydrocarbons projects that generate more than one gigatonne of CO₂ over their lifetime. Specialists say that this type of project needs to be shuttered as quickly as possible if the Paris Agreement timetable is to be kept.

Investments in fossil fuels by net-zero asset managers

Using data from the London Stock Exchange Data & Analytics, we identified funds classified as “green” under the European Sustainable Finance Disclosure Regulation (SFDR), in force since 2021. Articles 8 and 9 of the regulation govern the requirements to be met for marketing products as, respectively, having “environmental or social” objectives or being “sustainable investments”. The NZAM signatories that are most exposed to hydrocarbons accounted for 54 percent of all NZAM investments in this sector.

They include DWS (a German firm), JP Morgan, BlackRock, Northern Trust and AllianceBernstein (all American), France's Amundi, the Netherlands' Robeco, Norway's Storebrand and Italy's Eurizon. Together they held a stake of just over $14 billion in the oil and gas industry.

In 2023, many of these companies used terms such as “sustainability” and “innovation” to describe funds that held stakes in well-known oil giants. For example, the US firm State Street employed the words “Sustainable Climate” to market a fund that held a $7 million share in Exxon. Another fund, “Europe Climate Action”, marketed by Amundi, held $18 million of stakes in Aker, BP, Equinor, and TotalEnergies.

In the past year, new guidelines have set clear limits on the use of sustainability-related words in the names of funds that invest in fossil fuels.

However, as we showed in previous articles in this series, numerous asset managers continue to invest in dirty hydrocarbons while declaring their support for sustainability and ESG in their prospectuses to investors.

Overall, of the ten NZAM members that have made the largest share of “green” investments, the stakes involved total $18 billion. They include 82 extraction projects defined as “carbon bombs” by Kjell Kuhne of Lingo. According to Kuhne, “the amount of emissions generated [by carbon bombs] is greater than that emitted in a year by the whole of Germany, a highly industrialized country that is heavily dependent on fossil fuels”.

The investments made by the Net Zero Asset Managers have clearly not helped to convince their Big Oil beneficiaries to put a stop to these 82 “carbon bombs”. This despite the claim often made by asset managers that they can push the industry towards transition by means of their participation in company meetings and the votes they cast there. Furthermore, all ten firms mentioned are also signatories to the UN's Principles for Responsible Investment, despite continuing to invest in fossil fuels.

In a report published in November 2024, the UN PRI Association writes that policymakers should instruct financial firms to implement “robust carbon pricing and market-based mechanisms, accelerating the full and equitable phase out of fossil-fuel subsidies and establishing clear plans and targets for phasing out unabated fossil fuels in line with credible 1.5°C pathways”.

Kuhne, of Leave it in the Ground, is acerbic: ”These companies are actively creating these new CO2 bombs. When the climate is already in danger and spiraling out of control, not creating new carbon bombs should be the top priority."

“A green investment should not provide any money to companies involved in the fossil-fuel supply chain“, he concludes. ”It should be ‘fossil-free’, and for me this is a fundamental criterion for being able to call oneself green, sustainable, and climate-friendly. Today, these companies are the biggest obstacle to progress towards sustainability. If you were selling a green fund while investing in Exxon, you were simply deceiving your customers."

We asked Net Zero Asset Managers for comment on our findings but did not receive a response to date.

🤝 This article is published in collaboration with IrpiMedia; it is part of Voxeurop's investigation into green finance and was produced with the support of the European Media Information Fund (EMIF)

The sole responsibility for any content supported by the European Media and Information Fund lies with the author(s) and it may not necessarily reflect the positions of the EMIF and the Fund Partners, the Calouste Gulbenkian Foundation and the European University Institute.

Do you like our work?

Help multilingual European journalism to thrive, without ads or paywalls. Your one-off or regular support will keep our newsroom independent. Thank you!