An award-winning long tail investigation:

🏆 Covering climate now journalism awards 2024 – “Fossil fuels” category

🏆 Climate journalism award 2024 – “Fighting climate misinformation” category

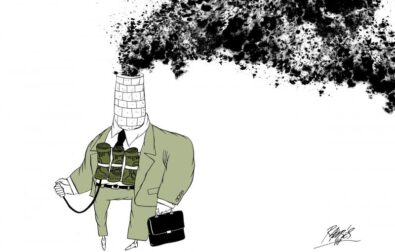

Using clever semantic tricks and loopholes in Europe’s regulations, asset-managers label and promote as “green” funds which pour investors’ money in climate-unfriendly, environmentally and socially harmful activities. Beneficiaries include companies active in oil & gas extraction, coal mining, steel production, agribusiness, fashion, weaponry, automotive, aviation and shipping.

In parallel, those same polluting companies also use loose voluntary standards to raise funding from investors and banks through green bonds with no binding conditions attached.

By spreading misleading messages about their supposedly sustainable transactions, through corporate websites, press releases, media reports and social media posts, the culprits of climate change are minimizing their responsibility and trying to look greener than they are.

As a result, dirty profits continue to be greenwashed through financial schemes that do not really require companies to reduce their carbon emissions and divest from activities damaging local communities.

This undermines the efforts towards a sustainable transition both in Europe and in all countries where European businesses operate.

Supported by Journalismfund Europe, the Bertha Foundation and the European Media Information Fund (EMIF)

📔 Stefano and Giorgio’s handbook on how to expose greenwashing and disinformation in the finance sector

📺 Stefano’s presentation of the Shady Green Finance investigation on YouTube: