Solidarity in exchange for responsibility: this was the slogan adopted by Angela Merkel when she reluctantly accepted to participate in the first Greek bailout a year ago. For the German Chancellor, it was then a matter of exporting her country’s much cherished "culture of stability" to the rest of Europe, and in particular to the countries of Southern Europe.

Against a backdrop of contagion that spread to Ireland and later to Portugal, the last 12 months have been marked by the launch of several initiatives that aim to take advantage of collective lessons learned from the Greek crisis: a reinforced Stability and Growth Pact, the European semester, the Euro-plus pact for economic convergence, and a framework for macroeconomic supervision.

In addition to the rescue funds created in response to a state of emergency, Eurozone countries are hoping to establish a system to prevent further existential crises. Speaking to European finance ministers gathered in Luxembourg on Monday 20 June, the International Monetary Fund’s temporary managing director John Lipsky insisted, “Without political union stronger governance of the euro area will be indispensable."

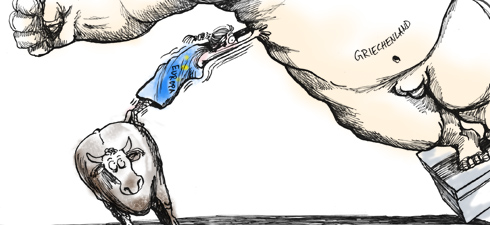

In the run-up to the European Council on 23 and 24 June, the reform of the Stability and Growth pact, which is the most important of these initiatives, has become subject of a tug-of-war between Europe’s member states and the European parliament. In response to a request from the French and the Germans who did not succeed in complying with it, the first version of the pact established in 1997 was made less stringent in 2005. This time around, it is on the point of being strengthened, at least on paper. Sanctions to act as brakes against fiscal irresponsibility and correct excessive deficits and/or indebtedness and are to be reinforced. And in wake of Greece’s doctoring of its books, statistical fraud will be punished by fines.

States have a tendency to absolve each other

The pact will be completed by an unprecedented dual system that will include the European semester — designed to allow European institutions a six-month window to express their views on the budgetary policies and reforms conducted by individual governments before these are adopted by national parliaments — and increased macroeconomic supervision, which will identify bubbles and other imbalances that could bring a sudden halt to the expansion of national economies. The scope of this supervision has been extended in the light of the observation that rapid growth in countries like Spain and Ireland, which complied with the Stability Pact, was fueled by highly dangerous imbalances, such as property bubbles and over development of the banking sector. The range of indicators that will be used to monitor balances of payments, trade balances, inflation and rates of employment has yet to be defined. And here too, states that fail to toe the line may be subject to sanctions.

It remains to be seen if the mechanism, which has all the complexity of a Rube Goldberg machine, will even function. Fearing that they will never be applied, European Central Bank President Jean-Claude Trichet has demanded that MEPs reinforce the automatic nature of new sanctions for violations of the Stability Pact — a position that is shared by the European Commission, and some European representatives. "The goal is to avoid bargaining between states, which have a tendency to absolve each other,” explains French centrist MEP Sylvie Goulard, rapporteur for the text on the sanctions.

Even if the sanctions are made more automatic, European national governments, led by Paris and Berlin, are seeking to keep control of the validation process for the Commission’s recommendations on the implementation of the stability pact. At the same time, France and Germany want this arsenal of measures to pave the way for the emergence of a form of economic governance in the monetary union.

Do you like our work?

Help multilingual European journalism to thrive, without ads or paywalls. Your one-off or regular support will keep our newsroom independent. Thank you!