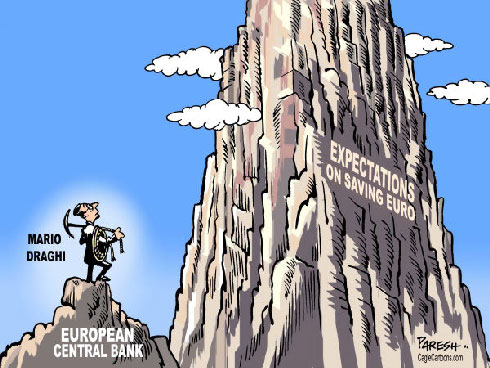

After a long-awaited meeting of the board of the European Central Bank (ECB), its president, Mario Draghi, announced a series of measures to alleviate pressure on countries like Spain and Italy, which are under pressure because of the high risk premiums they must pay to finance their debt. The ECB is to launch a new programme, "Outright Monetary Transactions" (OMT), where it will buy an "unlimited" amount of government bonds with maturities ranging from 1 to 3 years on the secondary market. However, these purchases will be subject to "strict compliance". Countries wishing to benefit will first have to seek assistance from the European Financial Stability Fund.

Was this article useful? If so we are delighted!

It is freely available because we believe that the right to free and independent information is essential for democracy. But this right is not guaranteed forever, and independence comes at a cost. We need your support in order to continue publishing independent, multilingual news for all Europeans.

Discover our subscription offers and their exclusive benefits and become a member of our community now!