Faced with inertia on the part of Eurozone governments, the ECB has stepped in to buy up massive quantities of Italian and Spanish debt. The goal is to ward off a threat of sovereign default in either country, which could sink the euro. But investors remain unconvinced.

“Will Italy destroy the euro?” wonders Die Presse, which illustrates its front page with a stormy sky over the Grand Canal in Venice. In its editorial, the Viennese daily deplores the initiative taken by the ECB, which it describes as a “political poodle”. Arguing that the financial institution has abandoned its independence by buying up large quantities of Italian sovereign bonds, the newspaper points out that the ECB “is not alone in its failure to respect European treaties: since the beginning of this year, the governments of the Eurozone, all of which claim to be law-abiding, have demonstrated a remarkably flexible understanding of their obligation to honour contracts. What about respect for the European stability pact and the pledge that no EU country would be held responsible for the debts of another member state? There are no two ways about it. This is precisely the approach that has plunged the Eurozone into an existential crisis.”

“Will Italy destroy the euro?” wonders Die Presse, which illustrates its front page with a stormy sky over the Grand Canal in Venice. In its editorial, the Viennese daily deplores the initiative taken by the ECB, which it describes as a “political poodle”. Arguing that the financial institution has abandoned its independence by buying up large quantities of Italian sovereign bonds, the newspaper points out that the ECB “is not alone in its failure to respect European treaties: since the beginning of this year, the governments of the Eurozone, all of which claim to be law-abiding, have demonstrated a remarkably flexible understanding of their obligation to honour contracts. What about respect for the European stability pact and the pledge that no EU country would be held responsible for the debts of another member state? There are no two ways about it. This is precisely the approach that has plunged the Eurozone into an existential crisis.”

“No holiday for the crisis,” headlines Libération, which reports that the European Central Bank deployed “heavy artillery” on 8 August, when it bought massive quantities of distressed sovereign bonds — without completely reversing the market trend. The Parisian daily also comments on “the major row” between countries in favour of the move and its opponents, most notably Germany, which is why we have “the impression that [ECB] President Jean-Claude Trichet is intervening reluctantly. As a result, the markets remain sceptical, and the impact on sovereign debt interest rates has been less than expected.”

“No holiday for the crisis,” headlines Libération, which reports that the European Central Bank deployed “heavy artillery” on 8 August, when it bought massive quantities of distressed sovereign bonds — without completely reversing the market trend. The Parisian daily also comments on “the major row” between countries in favour of the move and its opponents, most notably Germany, which is why we have “the impression that [ECB] President Jean-Claude Trichet is intervening reluctantly. As a result, the markets remain sceptical, and the impact on sovereign debt interest rates has been less than expected.”

“Europe saved” — reads the Tageszeitung headline alongside a picture of a determined Jean-Claude Trichet — “…or not” says the text next to a grim faced Silvio Berlusconi. The head of the ECB is attempting to calm the markets by buying up Italian sovereign bonds, while the Italian Premier continues to scare investors with “debts on a mountainous scale”. In any case, the Berlin daily argues that “the crisis will strengthen Europe” because it has prompted the first steps towards a true monetary union with a proper central bank.

“Europe saved” — reads the Tageszeitung headline alongside a picture of a determined Jean-Claude Trichet — “…or not” says the text next to a grim faced Silvio Berlusconi. The head of the ECB is attempting to calm the markets by buying up Italian sovereign bonds, while the Italian Premier continues to scare investors with “debts on a mountainous scale”. In any case, the Berlin daily argues that “the crisis will strengthen Europe” because it has prompted the first steps towards a true monetary union with a proper central bank.

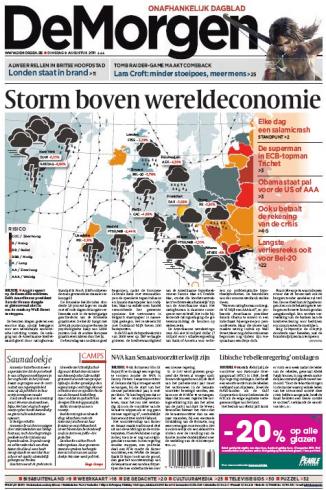

De Morgen reports on “the storm over the world economy” as though it was a meteorological phenomenon, with a front-page map showing the intensity of the disturbance over Europe and the US, figures for the previous day’s stock market losses marked in red, and colour codes to indicate countries’ sovereign debt ratings. The only positive consequence of “Black Monday” will be that “the drop in the price of oil will reduce fuel prices,” notes the Brussels daily.

De Morgen reports on “the storm over the world economy” as though it was a meteorological phenomenon, with a front-page map showing the intensity of the disturbance over Europe and the US, figures for the previous day’s stock market losses marked in red, and colour codes to indicate countries’ sovereign debt ratings. The only positive consequence of “Black Monday” will be that “the drop in the price of oil will reduce fuel prices,” notes the Brussels daily.

Headlining with "€5.000.000.000.000”, De Volksrant emphasises the sheer magnitude of losses. “In two weeks, 5 trillion euros have been wiped off global markets,” notes the Amsterdam daily, which evaluates the damage to “investment fund portfolios, pension funds, other financial institutions and private investors.”

“Stocks plunge amid recession fears,” headlines La Vanguardia, which remarks that “the G20 and the ECB were too tight in their calculations.” For the Barcelona daily, the “Black August” has demonstrated that the drive to restore financial stability and market liquidity will "require much more than fine words." There is a critical need "for fresh proposals and a major step towards better coordination and management of the global economy." We will have to see “much more trenchant action by the ECB.” At the same time, "Germany will have to overcome its reluctance to take the lead on the euro and avoid dragging its feet, or the crisis will be more costly for everyone."

“Stocks plunge amid recession fears,” headlines La Vanguardia, which remarks that “the G20 and the ECB were too tight in their calculations.” For the Barcelona daily, the “Black August” has demonstrated that the drive to restore financial stability and market liquidity will "require much more than fine words." There is a critical need "for fresh proposals and a major step towards better coordination and management of the global economy." We will have to see “much more trenchant action by the ECB.” At the same time, "Germany will have to overcome its reluctance to take the lead on the euro and avoid dragging its feet, or the crisis will be more costly for everyone."

Was this article useful? If so we are delighted!

It is freely available because we believe that the right to free and independent information is essential for democracy. But this right is not guaranteed forever, and independence comes at a cost. We need your support in order to continue publishing independent, multilingual news for all Europeans.

Discover our subscription offers and their exclusive benefits and become a member of our community now!