It is quite easy to buy diesel from Belarusian truck drivers who stop at the motorway service stations on the outskirts of Vilnius. But my car runs on petrol, so I went looking for a deal on the Internet.

Three quarters of the sellers were offering diesel, and it is easy to understand why: large quantities of diesel can be transported into the country in truckers’ fuel tanks, whereas petrol has to be smuggled in jerrycans on board cars and minibuses.

After several calls to phone numbers gleaned from websites, I was beginning to despair of finding anyone who had some petrol in stock when I finally happened on a seller who agreed to organise a rendezvous. “Do you know how to get to my garage?” he said — a question which indicated that the majority of buyers for contraband petrol are regular and loyal customers.

Occasional buyers like myself are much less common. The sellers do not like dealing with them, because there is always the risk that a new buyer may turn out to be an undercover policeman or tax inspector.

When I reached the garage, my contact was waiting outside in a blue Volkswagen. The passenger seat beside him was occupied by a vicious looking dog, who had no doubt been brought along to sniff out any prospect of hold-up. “How much do you want? he said.” I launched into my spiel: 40 litres would be enough for a first visit. But where had he obtained this petrol? Was it good quality? Could it be mixed with 92 RON petrol? In response to this barrage of questions, he calmly remarked, “No one has ever complained. My suppliers are very reliable. It is Belarusian petrol, 95 RON. You will see for yourself, it hasn’t been mixed.”

The cost to the taxman

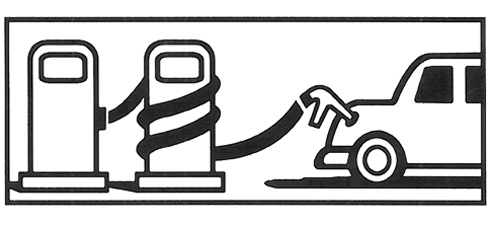

When he opened the garage door, I was hoping to see a fully equipped illegal service station with barrels of petrol piled up to the ceiling. But there was hardly anything there: just a few jerrycans, an electric pump and a hosepipe. My contact explained that he never stocked large quantities, so he could claim that the petrol was for his own use in the event of a surprise visit from the inspectors.

But how much was it going to cost? He asked for 3.40 litas (1 euro) per litre. On that day, a litre of 95 RON petrol was selling for 4.11 litas at service stations in Vilnius. If I had gone to an official garage, I would have paid 28.4 litas more for 40 litres. If I filled my tank at this back street operation once a week, I would save 114 litas a month. At the end of a year, the difference in price would amount to an extra 1,370 litas in my wallet.

What did this transaction represent in terms of material loss to the state? For every litre of petrol that is sold legally, the state receives approximately 2.2 litas. By filling my tank with contraband petrol, I was depriving the exchequer of 88 litas. If I made use of this source for an entire year, my lack of civic virtue would result in the loss of 4,500 litas in tax revenue.

But what about the cost of diesel? Illegally imported diesel is available at a cost of 2.40 litas per litre as opposed to the official service station price of 3.56 litas. Let’s imagine that a driver uses 700 litres per year. VAT and excise duty represent 44% of the price of a litre of diesel, so the loss of earnings to the state would amount to 1,100 litas, which is about what it costs to keep a child in school for one year.

Black market for cigarettes bigger than one for contraband fuel

In Lithuania, the black market for cigarettes is even bigger than the market for contraband fuel. But the cigarette sellers are even more difficult to track down than their petrol trading colleagues. Finally, I heard of a reliable source operating from a building in the Naujamiescio neighbourhood of Vilnius.

The cigarettes are sold through a ground floor window of one of the four-storey buildings on Algirdo Street. If anyone suspicious looking enters the area, the neighbourhood children immediately warn the sellers. “You have to knock on the glass,” whispered the buyer ahead of me. The window opened and the seller stuck his head out. Without a word the buyer handed over 3.30 litas and received in exchange a packet of Saint George. Then the window closed again.

In a shop, he would have paid 6.40 litas for exactly the same product. Excise and VAT accounts for 85% of the price of the cheapest cigarette brands, so for every packet that is sold illegally, the state had loses 5.44 litas. According to figures from a survey conducted by cigarette wholesaler JTI Marketing and Sale, 62% of Lithuanian smokers buy their tobacco on the black market — a statistic which indicates that the annual loss to the state amounts to 550 million litas.

Was this article useful? If so we are delighted!

It is freely available because we believe that the right to free and independent information is essential for democracy. But this right is not guaranteed forever, and independence comes at a cost. We need your support in order to continue publishing independent, multilingual news for all Europeans.

Discover our subscription offers and their exclusive benefits and become a member of our community now!